Cash conversion cycle: What it is and the metrics that matter

Also known as the net operating cycle or the cash cycle, the cash conversion cycle (CCC) is a key working capital metric. CCC measures the time period — in days — that it takes a company to convert investments in inventory into cash in the bank from sales.

It traces the velocity of cash through business processes, how long it is tied up as working capital before being collected from customers as ready cash. This also factors in the length of time payments to suppliers for goods and services received can be extended.

In this blog we will take a look at how the CCC is calculated, what a good CCC figure looks like, why it’s a crucial metric to monitor, and how process mining innovations from Celonis can unlock the insight to optimize your CCC.

How to calculate your Cash Conversion Cycle

The formula for calculating your Cash Conversion Cycle requires bringing together three other key business metrics:

Cash Conversion Cycle = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO)

Let’s take a quick look at each of these key ratios:

DIO: The average number of days a company holds its inventory before converting it to sales. Typically, the lower this figure the better as it indicates cash isn’t tied up in slow moving stock (which risks becoming obsolete).

DSO: The average number of days it takes a company to collect payment for credit sales. Again, a lower DSO is healthier for business cash flow and liquidity as cash owed isn’t sitting in someone else’s bank account.

DPO: The average number of days it takes a company to pay suppliers for goods or services bought on credit. Broadly, the higher this figure the better it is for business cash flow — rather than being tied up in working capital, the cash is free for deployment (or earning you interest).

Why is monitoring your Cash Conversion Cycle important?

Tracking the CCC metric enables your company to recognize and address any operational inefficiencies or pinch points which may impede free cash flow (FCF) and liquidity. By monitoring the number of days in the CCC, you can gain insights into the efficiency of your inventory management, accounts receivable collection, and accounts payable processes — both in broad operation terms but also, importantly, in terms of working capital management.

Cash flow, particularly in times of spiking inflation and volatile supply chain stability, is king. CCC provides a yardstick against which to measure your success in working capital management. It is a framework to measure success in minimizing cash tied up in business operations that could be used to meet financial obligations or for investment. This framework also provides the ability to accurately assess the success of any business optimization you initiate.

Careful monitoring of the CCC is particularly important for businesses whose success relies on efficient supply chain management. Those businesses that have a heavy reliance on production, storage and distribution of inventory need a means to determine the cash flow and cost avoidance impact of their supply chain efficiency. CCC provides this metric (and thus the underpinning data for any investment in optimization processes).

What is a good Cash Conversion Cycle figure?

The wide variance in the operational dynamics of individual industries means there’s no single figure to indicate what good would look like for a business. JP Morgan’sWorking Capital Index Report 2022 provides a CCC overall average from the S&P 1500 companies in 2021 (69.5 days). But an average isn’t the same as good.

Shorter is definitely better in CCC terms, though. A shorter CCC indicates inventory is being converted into sales and cash more rapidly. This reduces the time it takes to receive payments from customers and increases the time it can take to settle payables. This in turn means improved liquidity and working capital levels.

Negative Cash Conversion Cycles

In Cash Conversion Cycle terms, there’s nothing more positive than a negative CCC figure. Negative Cash Conversion Cycles occur when the cash from sales is collected before companies have to pay suppliers for the inventory sold. The product is bought by customers before it’s paid for by the seller.

This is a relatively rare situation that tends to occur where businesses have both a low Days Sales Outstanding ratio — a short period between credit sales and cash collection — and extended payment terms with vendors. One of the best examples of negative cash conversion cycles is Amazon, which sells its products rapidly, receives payment immediately and has the scale to negotiate deferred supplier payments. For the majority of businesses, however, ambitions target managing and minimizing the number of days in their cash conversion cycles.

Measure the CCC trend and compare with peers

Whether positive or negative, an individual CCC figure is only truly useful when measured as part of an ongoing trend. This is the only way to measure the working capital management performance over time. Businesses that not only monitor the overall CCC ratio but also the performance of its component parts (DIO, DSO, and DPO) are able to identify and address any deterioration. They are also able to make more informed decisions regarding opportunities for improvement going forward.

However, even in the absence of a high performance CCC benchmark, it is well worth seeking out sector-based KPIs in order to assess relative performance against competitors. Again, JP Morgan’s Working Capital Index Report 2022 provides a useful industry-by-industry breakdown of DIO, DSO, and DPO ratios from the S&P 1500 companies in 2021. With these industry benchmarked components, it’s possible to calculate where your business stands against its peers. But, to reiterate, it’s the trend in CCC rather than the snapshot that is of greatest significance.

How to improve your Cash Conversion Cycle

As CCC is a business-wide measure taking in most of the largest, most complex business functions, pinpointing where and how to instigate CCC improvements is a major challenge. There are so many interacting people, processes, and systems involved — each with their own challenges, as Celonis’ report The State of Business Execution in 2021 illustrated. It highlighted the top three obstacles faced by key departments:

Accounts Payable

Rigid systems and technologies

Broken or inefficient processes

Organizational silos

Accounts Receivable

Rigid systems and technologies

Fragmented data landscape

Broken or inefficient processes

Procurement

Lack of executive sponsorship

Fragmented data landscape

Broken or inefficient processes

Order Management

Lack of flexible logistics networks

Lack of visibility into processes

Lack of visibility into supplier performance

Any one of these challenges can result in operational bottlenecks and missed opportunities to drive down DIO and DSO, increase DPO — and therefore shorten the cash conversion cycle. Process mining can help identify and address these issues, thereby optimizing working capital management.

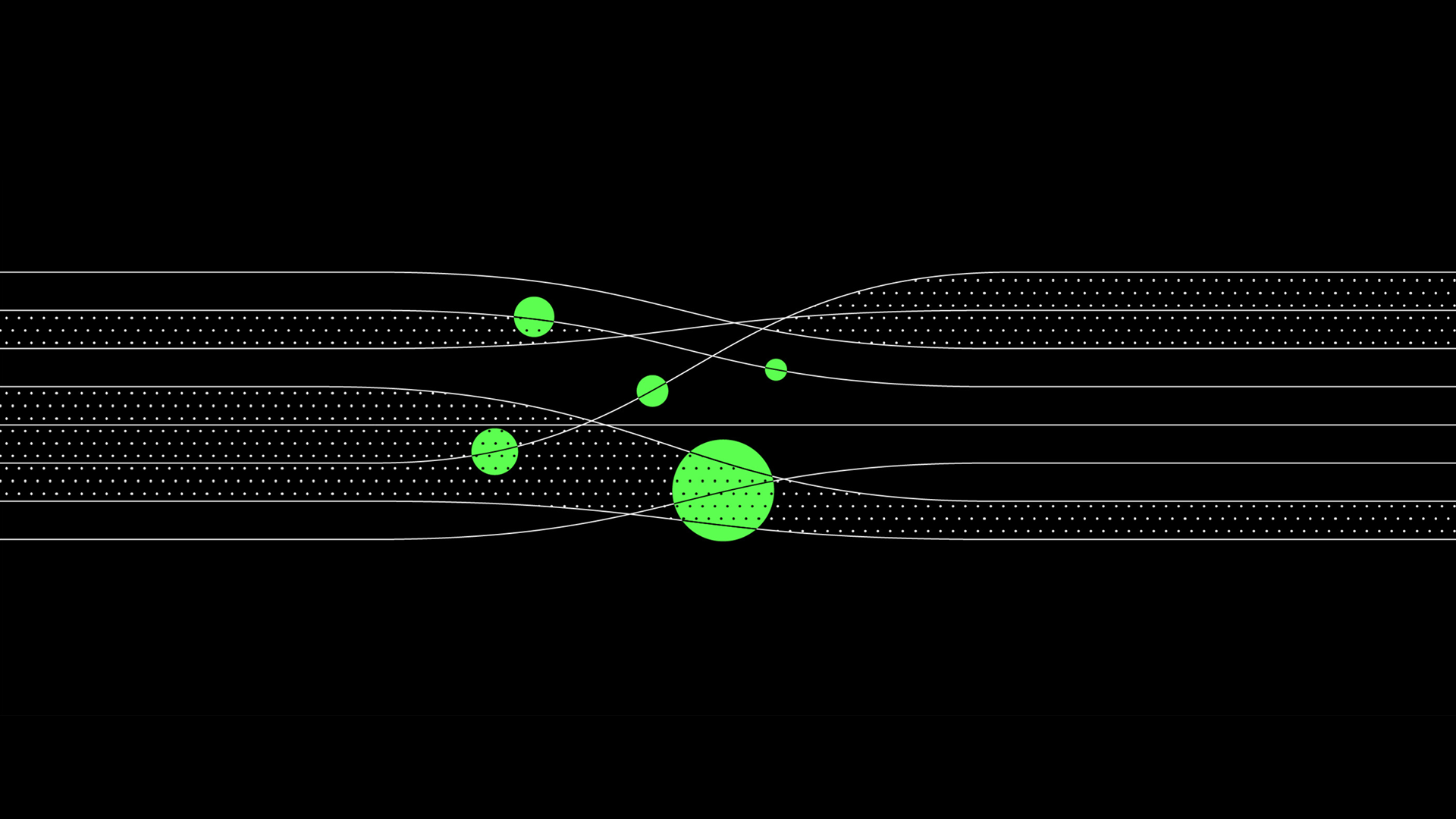

Process mining provides a high-definition MRI for business processes, extracting and aligning knowledge from event logs underpinning information systems to visualize the process performance across the business. With the single source of truth it provides, process mining enables stakeholders to drill down and understand the root cause and location of any suboptimal processes (such as excess inventory or tardy cash collections). Simultaneously it provides clarity of insight and reporting in order to measure the impact of CCC optimization processes.

The next generation of Cash Conversion Cycle optimization

It’s going to get easier to optimize your CCC. Advancing technology is providing ever-more advanced tools to visualize, analyze, and address opportunities for improvement. One such next-generation tool is Celonis’ End-to-End Lead Times App (E2E). It addresses arguably the most multifaceted, rapidly evolving, and difficult to wrangle aspects of the cash conversion cycle: days inventory outstanding.

In supply chain management there are a dizzying number of variables to oversee: having the right materials on hand in the right place at the right time without stockpiling excess inventory or risking stockouts (insufficient inventory to meet demand). This requires a minute understanding of timeframes for material acquisition, goods manufacture, transport, storage, distribution and fulfillment.

These processes are typically managed by different people in different locations, often with different systems and approaches. Until recently, understanding this end-to-end lead time would have required multiple process mining expeditions, analyzing the data logs for multiple functions. The E2E app has put an end to that. Using object-centric data mining and Celonis’ Object-Centric Data Model the E2E app unites business-wide insight across all functions involved in procurement, manufacturing and distribution, all in a single data model. This enables businesses to identify and address any practices impeding optimal DIO, and thus optimal CCC.

Whichever approach to optimizing the cash conversion cycle businesses prefer, the importance of keeping a tight rein on each of the component parts and component processes is only set to increase. But if new technologies and new approaches can offset the impact of volatile trading conditions on your working capital management…let them.

Learn more: